ETH Price Prediction: Bullish Momentum Building Toward $5,000+ Target

#ETH

- Technical Strength: Price trading above 20-day MA with improving MACD momentum suggests underlying bullish sentiment

- Institutional Accumulation: Major investments and record staking demand creating substantial buying pressure

- Ecosystem Development: Foundation selling directed toward long-term growth rather than market speculation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Consolidation Pattern

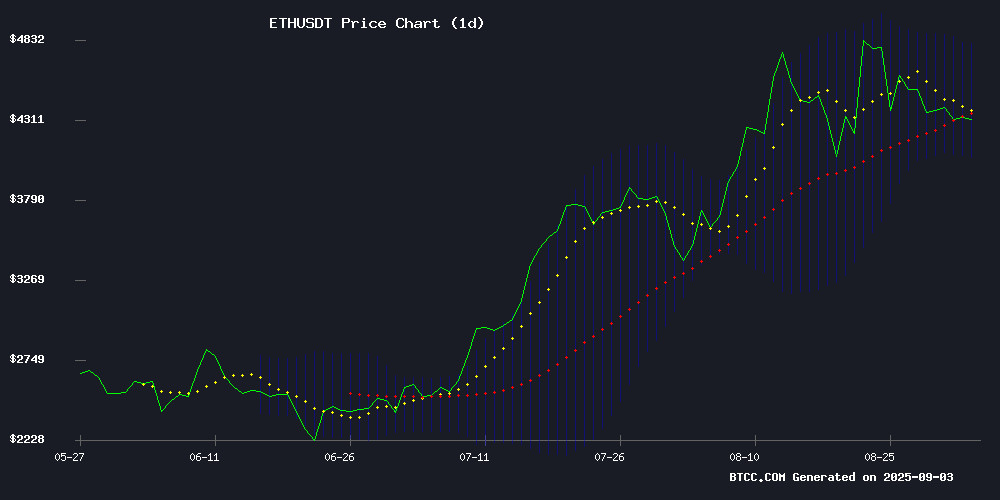

ETH is currently trading at $4,444.50, slightly above its 20-day moving average of $4,444.05, indicating near-term stability. The MACD reading of -42.99 versus -87.71 signal line shows improving momentum despite remaining in negative territory. Bollinger Bands position the price between $4,077.46 support and $4,810.63 resistance, suggesting a consolidation phase with potential upward bias.

According to BTCC financial analyst James: 'The technical setup suggests ETH is building a base for potential upward movement. Trading above the 20-day MA while MACD shows signs of convergence indicates weakening selling pressure.'

Market Sentiment: Institutional Demand Offsets Foundation Selling

Ethereum ecosystem developments present a mixed but ultimately positive picture. While the ethereum Foundation's planned $43M ETH sale creates temporary supply pressure, this is significantly outweighed by substantial institutional accumulation. Record staking demand hitting two-year highs, $8.4B in derivatives market resilience, and major corporate investments from firms like Yunfeng Financial and SharpLink demonstrate robust institutional confidence.

BTCC financial analyst James notes: 'The foundation's gradual selling is strategically focused on ecosystem development, while institutional inflows totaling hundreds of millions indicate strong fundamental demand. This creates a net positive supply-demand dynamic despite short-term volatility.'

Factors Influencing ETH's Price

Ethereum Foundation Sells $43M ETH to Fund Ecosystem Development

The ethereum Foundation has initiated a strategic sale of 10,000 ETH, valued at approximately $43 million, to secure funding for research, grants, and operational expenses. The transaction will be executed through centralized exchanges in smaller increments over several weeks to minimize market disruption.

Proceeds from the sale will support core development initiatives and community growth programs within the Ethereum ecosystem. This move follows the Foundation's $32 million grant distribution in Q1 2025 to developers and researchers working on protocol improvements and education efforts.

The treasury management decision reflects a long-term approach to ecosystem funding, prioritizing sustainable development over short-term price fluctuations. The Foundation recently paused open grant applications to focus on high-impact projects.

Ethereum Staking Demand Hits Two-Year High as Institutions Pile In

The Ethereum staking queue has swelled to its largest size since 2023, with 860,369 ETH ($3.7 billion) awaiting validation. Institutional players and crypto treasuries are driving the surge, capitalizing on attractive yields amid rising ETH prices and record-low gas fees.

"This level of demand hasn't been seen since the Shanghai upgrade enabled withdrawals," noted staking provider Everstake. The firm attributes the growth to three factors: strengthened network confidence, favorable market conditions, and accelerating institutional adoption.

Meanwhile, the staking exit queue has receded, alleviating concerns about potential sell pressure following Ethereum's recent all-time high. The near-parity between entry and exit queues suggests balanced market dynamics.

$8.4B and Unbroken: Ethereum Derivatives Market Defies Price Weakness

Ethereum's derivatives market is displaying unexpected resilience as the asset struggles to maintain its footing above $4,300. Despite a 1.4% decline today and choppy price action throughout the week, Binance's ETH open interest has held steadfast above $8.4 billion—a threshold it first touched on August 30.

The stability in open interest contradicts typical market behavior, where sharp price drops usually trigger proportional declines in OI through liquidations or risk aversion. Traders appear to be holding positions, suggesting either anticipation of a rebound or skepticism about further downside.

Notably, the pace of OI contraction has slowed. Binance's ETH OI now shows a 24-hour change of -3.4%, compared to -6.25% two days prior. This moderation hints at waning deleveraging pressure, with the derivatives market refusing to amplify the sell-off.

Meanwhile, Binance's Net Taker Volume remains entrenched in negative territory between -1.08 billion and -1.11 billion, painting a picture of cautious Optimism beneath the surface volatility.

Ethereum Staking Queue Hits $3.7B, Highest Level Since 2023

The Ethereum staking entry queue has surged to 860,369 ETH, worth approximately $3.7 billion, marking the highest level since 2023. Institutional demand and rising Ether prices, now around $4,321, are driving renewed confidence in long-term staking strategies.

Over 70 treasury participants now hold 4.7 million ETH, with most allocated to yield-generating strategies. The queue's growth signals strong trust in Ethereum's long-term potential, according to staking protocol Everstake. "We haven’t seen queues of this size since 2023," the firm noted.

The Shanghai upgrade in 2023 initially triggered validator exits, but the current influx of capital has alleviated concerns about mass withdrawals. Ethereum now has 35.7 million ETH locked in staking contracts, reinforcing network security.

Ethereum Foundation to Sell 10,000 ETH in Gradual Fiat Conversion

The Ethereum Foundation plans to sell 10,000 ETH over several weeks, opting for smaller, staggered orders rather than a single large transaction. The proceeds will fund ongoing research, development, and ecosystem support initiatives.

Strategic execution via centralized exchanges aims to minimize market impact. The MOVE reflects prudent treasury management rather than a bearish signal, as the Foundation routinely converts portions of its ETH holdings to sustain operations.

SharpLink Expands Ethereum Treasury to 837,230 ETH Amid Stock Struggles

SharpLink, a Minnesota-based firm, has aggressively expanded its Ethereum holdings, purchasing 39,008 ETH between August 25 and August 31 at an average price of $4,531. The $176 million buying spree brings its total treasury to 837,230 ETH, valued at approximately $3.6 billion. The acquisitions were partially funded by $46.6 million raised through its at-the-market equity program.

Despite the bullish ETH accumulation, SharpLink’s stock performance has failed to excite investors, particularly as September opened with waning risk appetite for volatile assets. The company’s ETH concentration ratio—measuring digital assets relative to cash—has nearly doubled since early June, now standing at 3.94. For every dollar of cash on hand, SharpLink holds close to four dollars in ether.

Cumulative staking rewards have reached 2,318 ETH since the firm launched its Ethereum-denominated treasury strategy on June 2. Co-CEO Joseph Chalom emphasized the precision of the treasury strategy, highlighting consistent growth in ETH holdings and staking rewards.

Yunfeng Financial Invests $44 Million in Ethereum to Bolster Web3 and RWA Initiatives

Ethereum's institutional adoption accelerates as Yunfeng Financial Group, a Hong Kong-listed firm linked to billionaire Jack Ma, acquires 10,000 ETH worth $44 million. The investment, funded through internal reserves, aligns with the company's July 14 disclosure of plans to expand into Web3, real-world asset tokenization, and AI.

Yunfeng explicitly selected Ethereum over other digital assets to support infrastructure for RWA tokenization. "This measure facilitates our technological innovation in Web3," the firm stated, emphasizing the integration of finance and technology to enhance client service experience. The group also hinted at exploring ETH's potential applications in insurance.

Ethereum NFT Activity Hits Historic Low Amid Sector Decline

Ethereum's NFT market has collapsed to unprecedented levels, with just 1,127 non-fungible tokens recorded on August 1, 2025—the lowest figure in the network's history. The downturn marks a stark contrast to the 2021-2022 boom, when NFTs dominated crypto headlines and trading volumes surged.

Analysts point to waning investor interest, an oversaturation of low-quality collections, and capital migration toward LAYER 2 DeFi solutions and real-world asset tokenization. The decline threatens Ethereum's fee economy and raises questions about the viability of NFT marketplaces.

July's brief resurgence—where NFT trading volume spiked 96% to $530 million—proved short-lived. While average NFT prices rose, the sector failed to sustain momentum as crypto markets rebounded in 2024-2025.

Ethereum Rally Fueled by Institutional Demand on Binance

Ethereum's recent price surge appears driven by large-scale orders on Binance, signaling a shift from retail-dominated trading to institutional accumulation. Average ETH order sizes on the exchange have surpassed $3,000 per trade—a threefold increase from 2023-24 retail-driven phases.

Analysts at CryptoQuant identify three distinct market phases: red periods of retail speculation (2023-24), gray neutral zones of fragmented participation, and the current green phase of whale dominance. This structural change coincides with ETH's sustained upward trajectory since mid-2025.

Binance's order FLOW data suggests sophisticated investors are rebuilding positions, contrasting with earlier cycles where small traders left the market vulnerable to sharp corrections. The platform remains the primary venue for this institutional activity, with no comparable whale signals observed on rival exchanges.

How High Will ETH Price Go?

Based on current technical indicators and fundamental developments, ETH appears positioned for upward movement toward the $4,800-$5,200 range in the coming weeks. The combination of strong institutional demand, record staking activity, and resilient derivatives markets provides solid foundation for price appreciation.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $4,800-$5,000 | High | 2-4 weeks | Institutional accumulation, staking demand |

| $5,200-$5,500 | Medium | 6-8 weeks | ETF developments, broader market rally |

| $4,200-$4,400 | Low | Support level | Technical support, foundation selling absorption |

The $4,077 Bollinger Band support provides a strong floor, while overcoming the $4,810 resistance could accelerate momentum toward higher targets.